YWR: Do you know what your PE Fund is up to?

Everyone knows a good institutional portfolio should have 30% allocated to Private Equity and Venture Capital.

But do you know what this 30% is doing? Probably not.

Every quarter YWR reviews the data on Private Equity and Venture Capital fund deal flow. For stock investing it helps to know what this growing segment of the market is doing.

I’ve linked a data spreadsheet at the bottom with all the Q1 Deals so you can look at all the deals by PE or VC fund.

State of the Industry

A few industry level charts before we get into the deals.

Deal flow is down and exits are also at reduced levels.

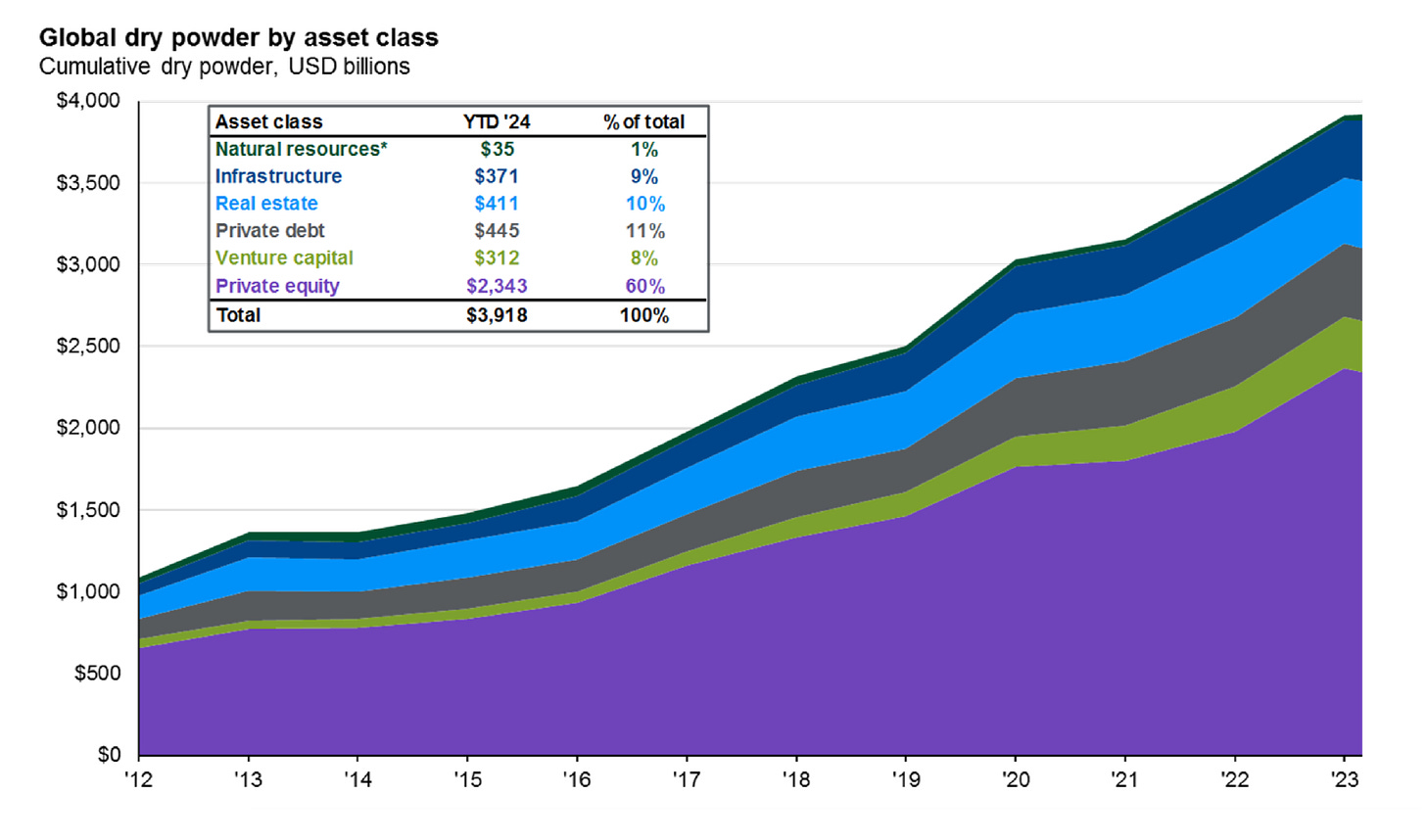

The dry powder continues to grow. Now at $3.9 trillion.

Direct lending and aircraft leasing/shipping have the most attractive yields.

Top Deals in Q1 2024

There were 188 deals in Q1 with a stated value over $50 million.

Vantage Data Centers

The biggest deal by far in Q1 was Vantage Data Centers raising $6.5bn in a round led by Silver Lake and Digital Bridge. The $6.5bn is in addition to $1.5bn raised from AustralianSuper. Vantage Data Centers was created by Silver Lake in 2010.

Moonshot AI

Moonshot AI raised $2bn in two different rounds (Beijing Dark Side of the Moon and Moonshot AI). Both Alibaba and HongShan (formerly Sequoia’s Asia business).participated. Moonshot AI was formed in March 2023 by Yang Zhiling who used to work for both Google and Meta, but less than a year ago set up his own AI company to focus on LLM’s capable of handling larger prompts.

This is another shot across the bows that Chinese tech is more active than you think. We should not be ignoring all the cheap tech stocks in China ( StirlingAI | Cracking the Code ‘s Dragon 7).

Echelon Data Centers

Another datacenter capital raise of $850mn. You can see why ETN 0.00%↑ and$ VRT 0.00%↑ have more orders than they can handle and all the hedge funds are long.

Figure AI

This is the AI robotics company which amazed us recently.

MiniMax

Another Chinese AI company. MiniMax raised $600mn with Alibaba and HongShan also participating.

Recurrent Energy, MN8 Energy, rPlus: all solar developers.

Monzo

The UK digital bank raised £350mn to expand in the US. Google, HongShan, Tencent and the Abu Dhabi Growth Fund participated.

Top 20 Deals under $100mn

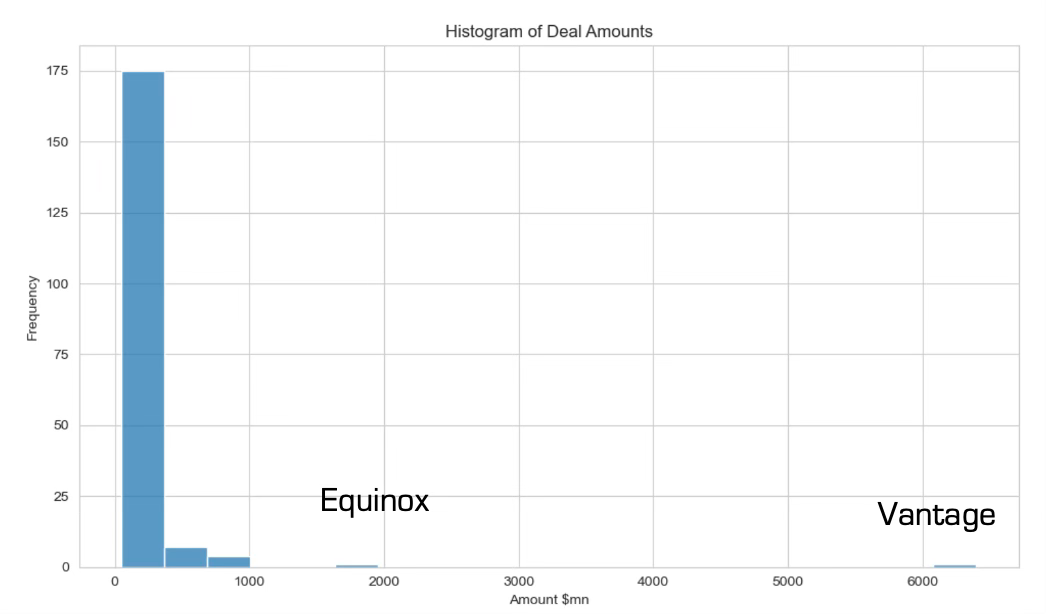

Histograms of Deal Activity by Size

As you can see the Vantage and Equinox deals are outliers. Most deals are below $100mn.

Most Active Funds Q1 2024

To calculate fund activity I sum every deal where a fund is participating. The data doesn’t show each fund’s $ participation in a deal, so funds participating in big deals, like the Vantage Data Center deal, come out looking as most active.

There were 188 deals in Q1 2024 with a stated value over $50mn.

Biggest Cities Globally for Private Equity and VC by AUM

We grouped 624 global PE & VC firms by city and AUM.

Favorite Industries for PE & VC Investment.

We grouped 46,200 PE & VC portfolio companies by Industry.

Software is by far the favorite industry (over 11,600 portfolio companies).

Least Favorite Industries for PE & VC Investment

Everything YWR owns. Major banks, autos, tobacco, coal, insurance, refining, precious metals.

Below is a link to the Excel database with the deals. You can look at every deal and who participated.

Disclosure:

Q1 2024 deals.

Datasource is FactSet.

Not all deals have a $ amount

Most deals do not have complete data on all participants.

188 deals with a stated value over $50 million

1,931 line items (data is by deal and fund so multiple line items when multiple funds involved)