YWR: Hedge Fund Holdings Analysis

Our monthly hedge fund review where we look at positioning to get ideas.

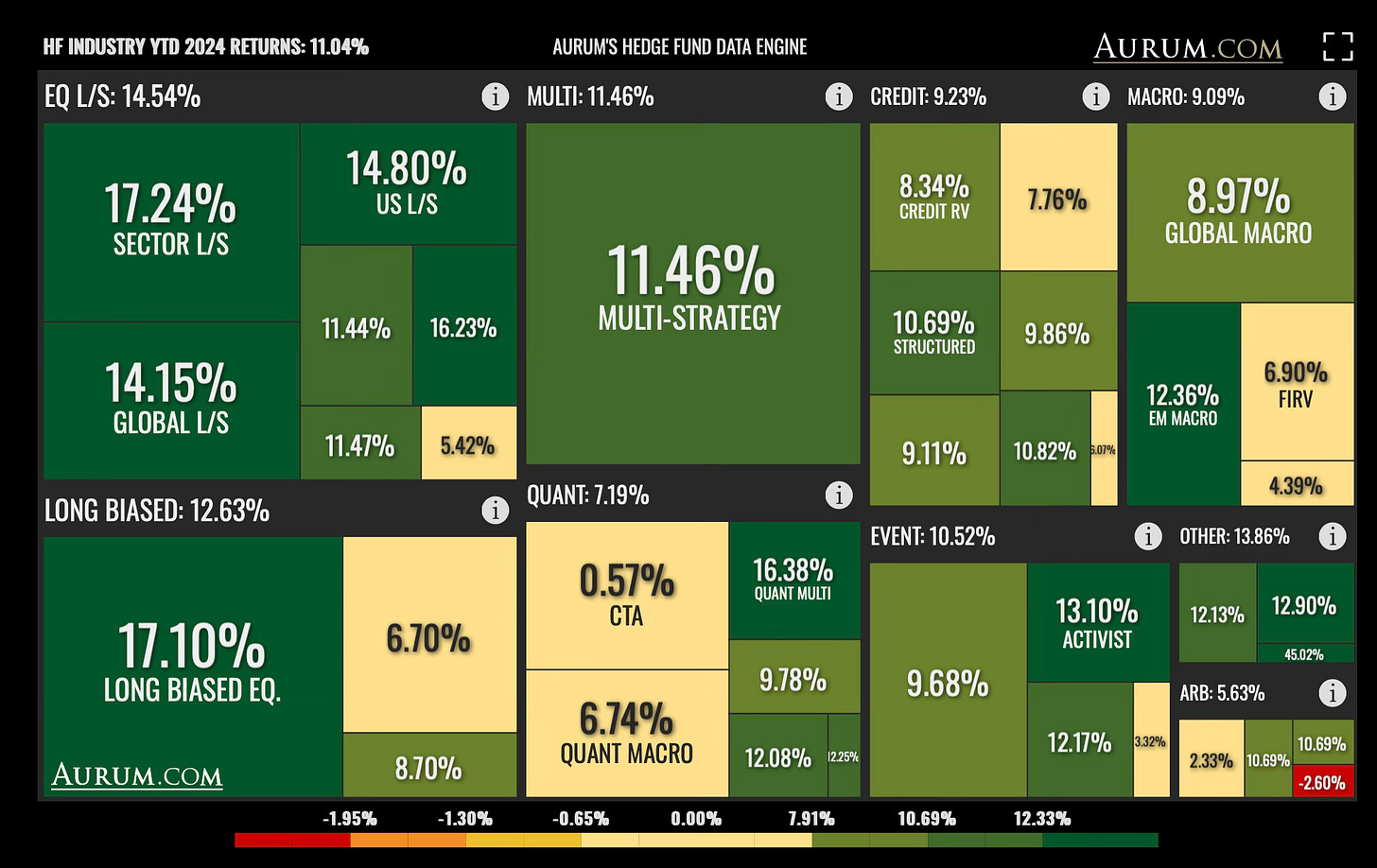

Strategy Review

2024 has been a great year for practically every strategy; L/S Equity, Multi-Strat, Credit, Event Driven, even Global Macro is putting in a respectable year. Yes, this is in the context of a +27% year in the S&P 500, so massive opportunity cost, but hedge fund investors just want their ‘uncorrelated’ 8%. And they are getting it.

Only CTA’s are struggling, but CTA investors won’t mind. It’s usually there for insurance.

Will 2025 be the year of the CTA?

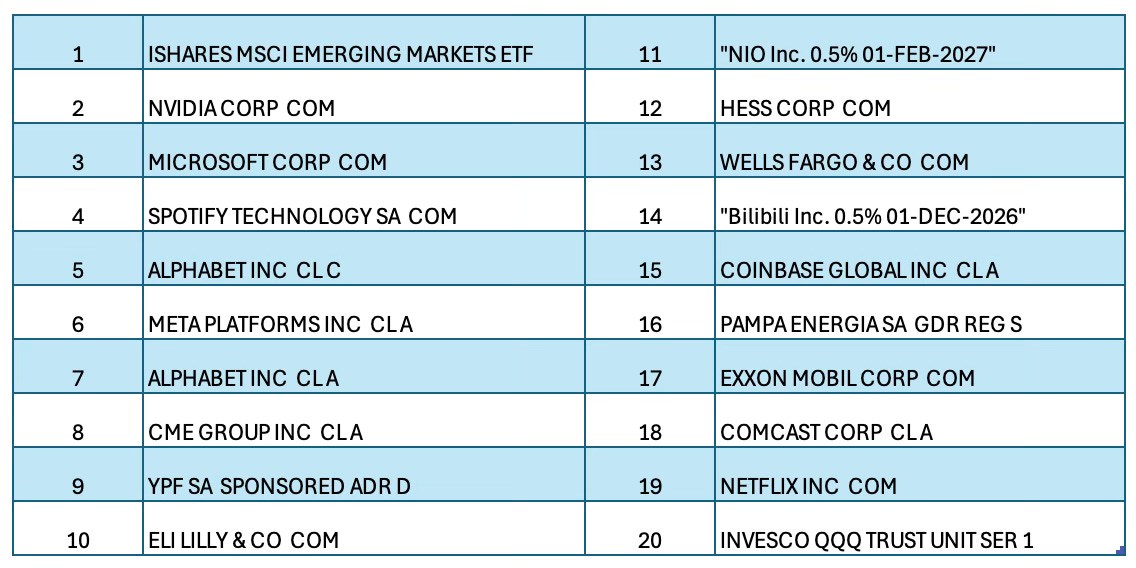

Top 21 Most Consensus Positions

We analyse the Top 20 equity positions at 338 hedge funds to see which equity positions are most commonly owned (‘Top 21 Most Consensus List).

Broadcom has moved up to become a top holding from not even on the list earlier this year. It replaces Advanced Micro Devices.

Tesla went from not on the list to a top position.

Salesforce is sliding down.

Top S&P 500 stocks not on the list: Berkshire Hathaway, JP Morgan, Exxon, Costco, Walmart, Oracle.

After a 400% move 23 funds own Carvana.

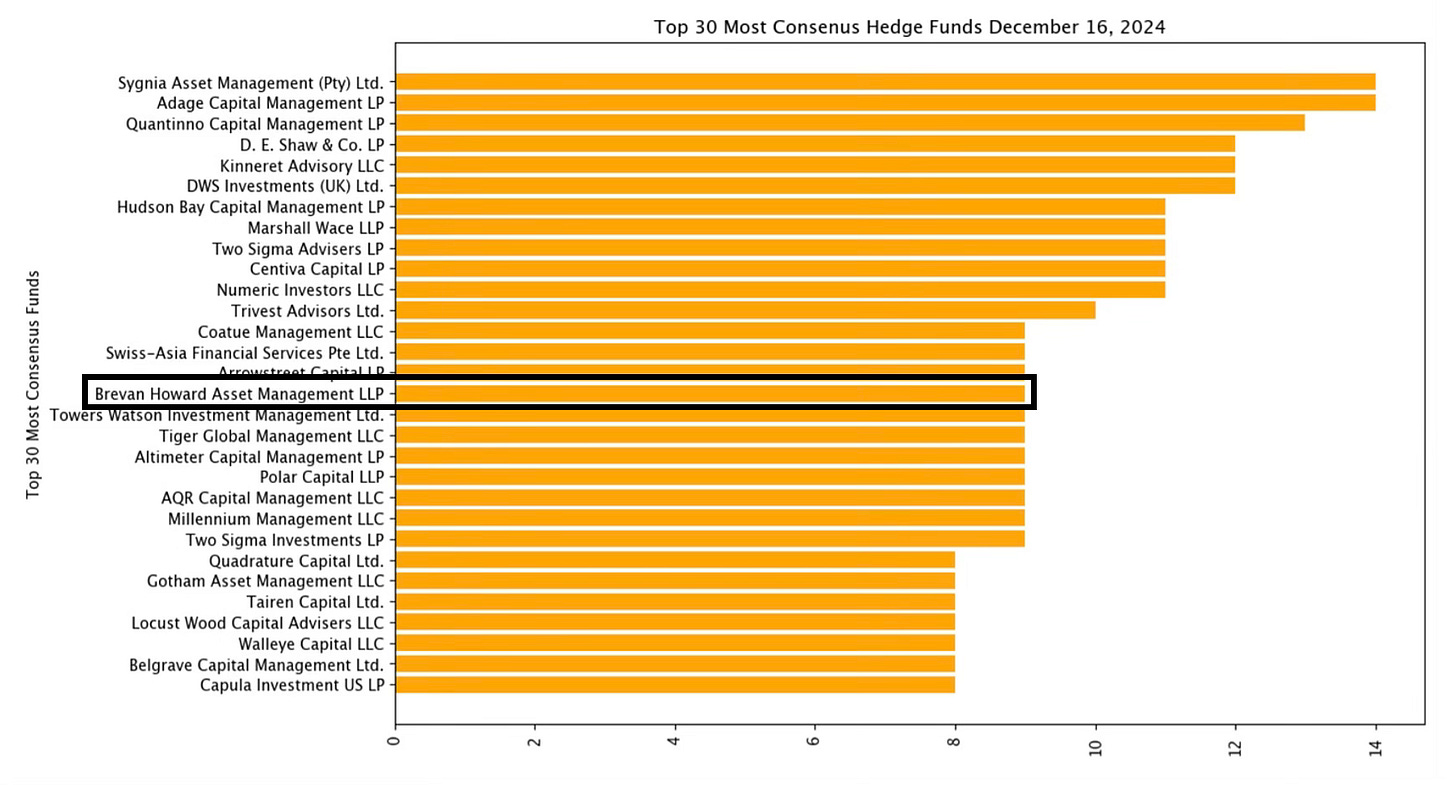

Most Consensus Funds

Analysis of which funds have the most overlap between their Top 20 and the YWR Top 21. Note: It’s the YWR Top 21 because Alphabet has 2 share classes and everyone owns it.

Brevan Howard Holdings

Brevan Howard is notable, because it wasn’t on the most consensus fund list earlier in the year. It’s interesting to see them halfway up the list now.

We’ve searched the YWR Hedge Fund holdings data for December (link at the bottom of the post) to see what they own. Note, this does not include anything BH is doing in options, futures, fixed income, etc. It’s just public equities.

Coinbase holding is differentiated and fits with their Digital Asset strategies.

Comcast, YPF, Wells Fargo and Pampa Energia are non-consensus.

Funds are attracted to CME because it has lagged ICE. Maybe it’s kind of interesting.

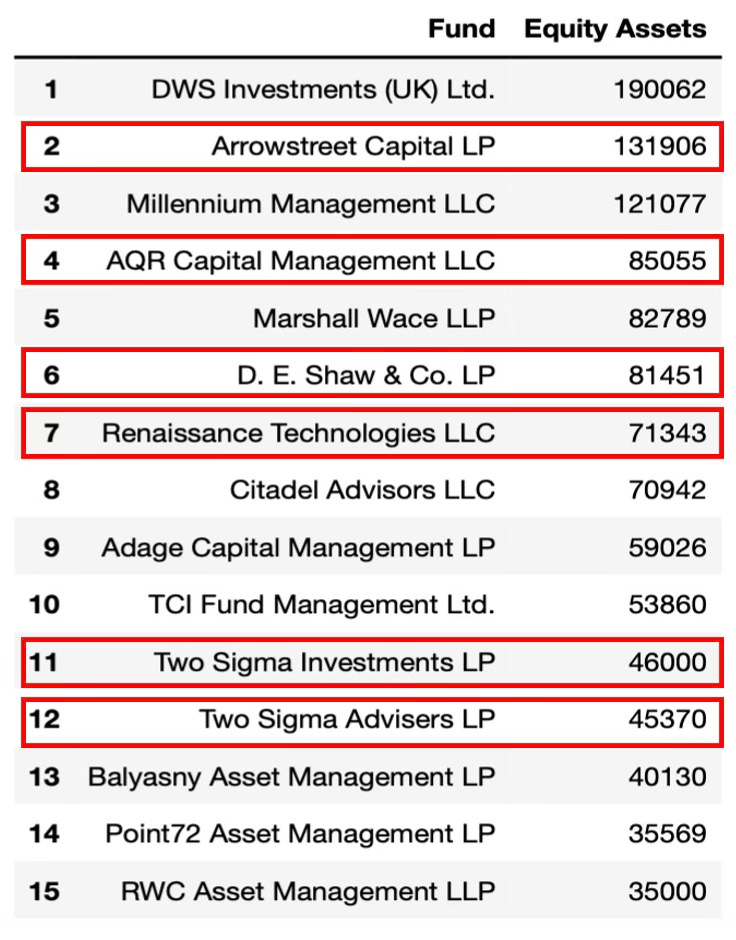

The Death of the Fundamental Analyst

When we look at the Top 15 funds by Equity AUM it stands out how many of the funds are purely quant strategies. I’ve highlighted in red the pure quant strategies, but most names of the list have a heavy quant focus now, like Citadel.

The attraction of ‘Quant’ is that it sounds good and answers the ‘investment process’ question perfectly. The hedge fund is a scientific machine which will consistently churn out results.

Gone are the days of “finding great companies”, now you need to have a Physics PHD. It doesn’t matter if you know anything about business, markets or sociology. It’s all math.

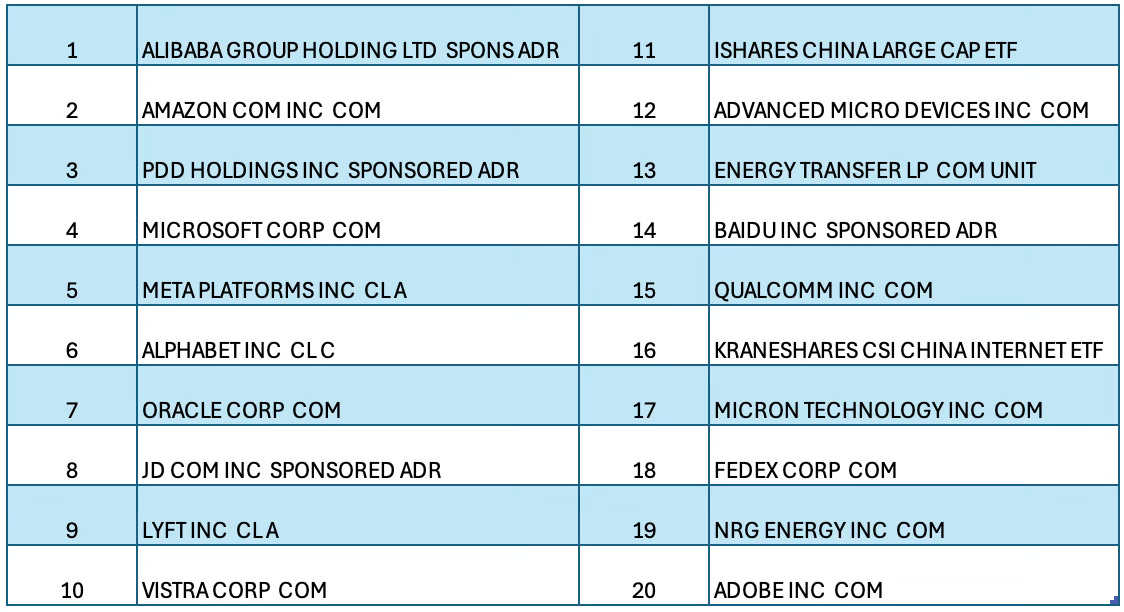

Fund of the Month: Appaloosa LP

Every month we highlight a fund from the YWR Hedge Holdings Data (link at the bottom). This month we look at David Tepper’s Appaloosa fund.

The standout is how many China positions they own (Alibaba, PDD, JD.com, iShares China, Baidu, Krane China Internet).

We highlighted Qualcomm in the Global Factor Model.

Kind of amazing when you look at the charts of NRG (utility with a 1.7% dividend yield) and Energy Transfer Partners (pipelines). Everything in the US is up and to the right.

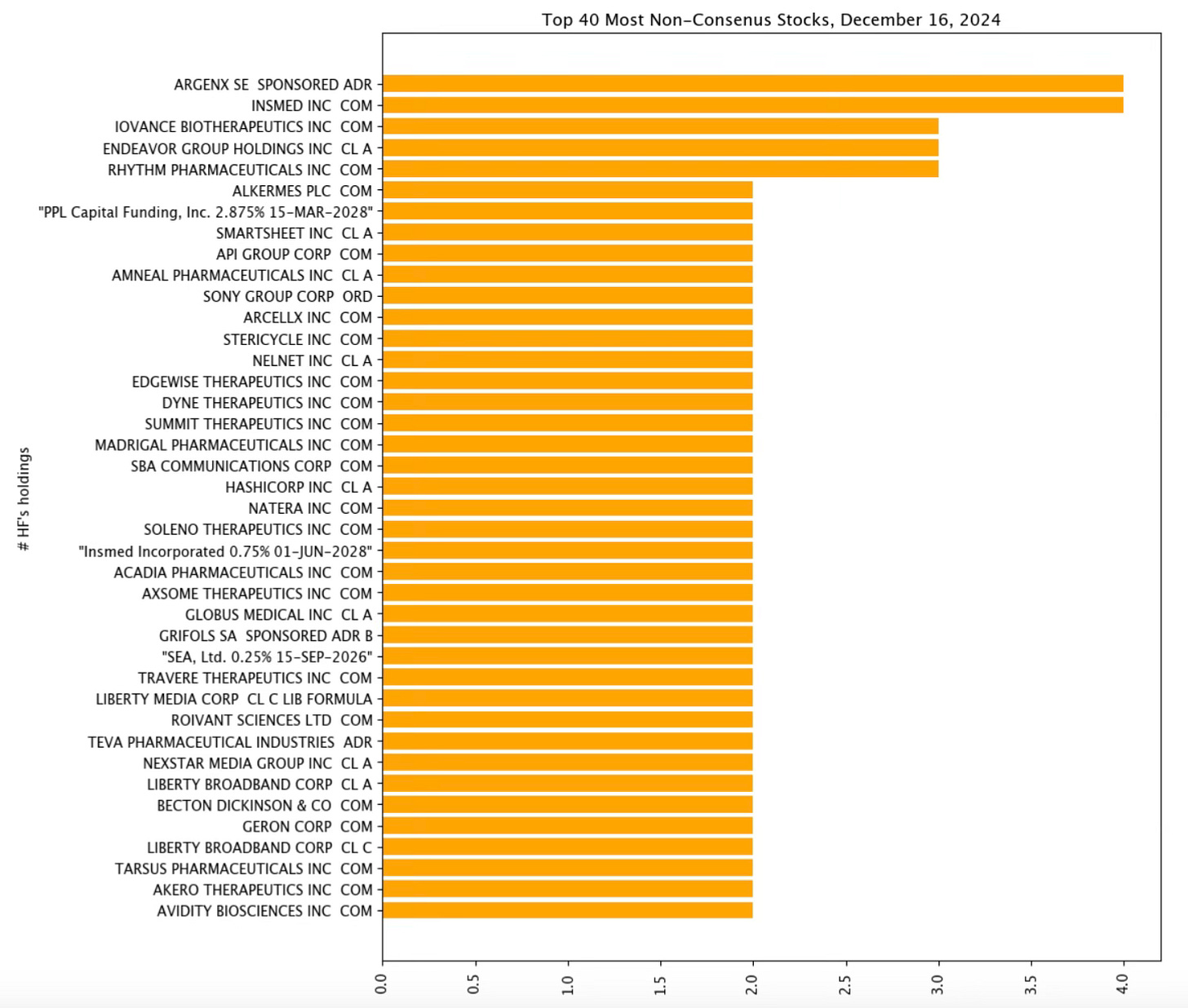

Non-Consensus Top Ideas

We analyse funds which have zero overlap with the YWR Top 21 to see what they like, ie what’s consensus amongst the non-consensus.

It’s a lot of biotech, but Sony stands out.

Final thought going into 2025

Did you notice something about all of this data?

There is no energy exposure aside from one merger arb play.

No gold either..

Hedge Holdings Data

Below is the hedge fund holdings data on the Top 20 public equity positions for over 1,000 global funds.

The data is also on www.ywr.world under the ‘Data and Models’ tab.