YWR: Killer Charts

Disclosure: These are personal views and market commentary. Not investment recommendations or guidance. For that seek professional help.

China….

So much ink spilled this week over whether a 10bp interest rate cut should have been 25bps.

And so many views on how China should be doing all the stupid things we do when our economy slows down.

Make rates 0%!!!

Make consumers leverage their brains out more!!!!

Inject money into people’s bank accounts!!!!

Anything to avoid dealing with things in a slower, but more sustainable way….

And everyday Chinese and HK stocks get sold off on the same news.

But let’s take a look at some earnings. Something no one bothers to talk about, because it’s easier to get macro and avoid the complexities of details.

And why are we doing this… because it looks like the problems for Chinese stocks are more than in the price while US markets are the opposite.

Let’s do China Merchants Bank, Alibaba and Tencent.

China Merchants….

It’s the best private bank in China and the bank everyone likes to own (leading card business). The valuations and metrics on the Big 4 are more extreme (BOC, ICBC, CCB, ABC), but we’ll use CMB.

Stock price down 50% from the highs.

Trading at 0.7x book, pretty much all time lows since listing. It used to trade over 3x book.

6% dividend yield. Also near all time highs.

In the chart below you can see the last big China bear period was 2015 and if you’d bought CMB then at HK$ 15/share it would have been +100% by 2017.

Meanwhile Last 12 month earnings for CMB grow to new highs.

Let’s look at the Q1 2023 earnings (below).

Net interest income growing, but fees down and expenses up, so operating profit -4.3% in Q1. Not exactly a disaster.

Meanwhile loan losses are declining so net profit grew 7.6% yoy.

If this earnings report said JP Morgan at the top you would be fine with it.

Let’s look at asset quality.

NPL’s at 0.95% of loans… with real estate just 5.6% of loans.

The annualised provisioning rate is 1% of loans

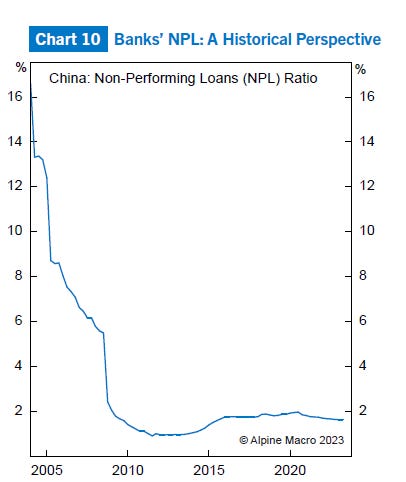

Just interesting to see in the chart below that Chinese banking system NPL’s have been running at 2%.

Yes, we should expect NPL’s to rise, but at what point are we over discounting everything and getting too far ahead of the headlights?

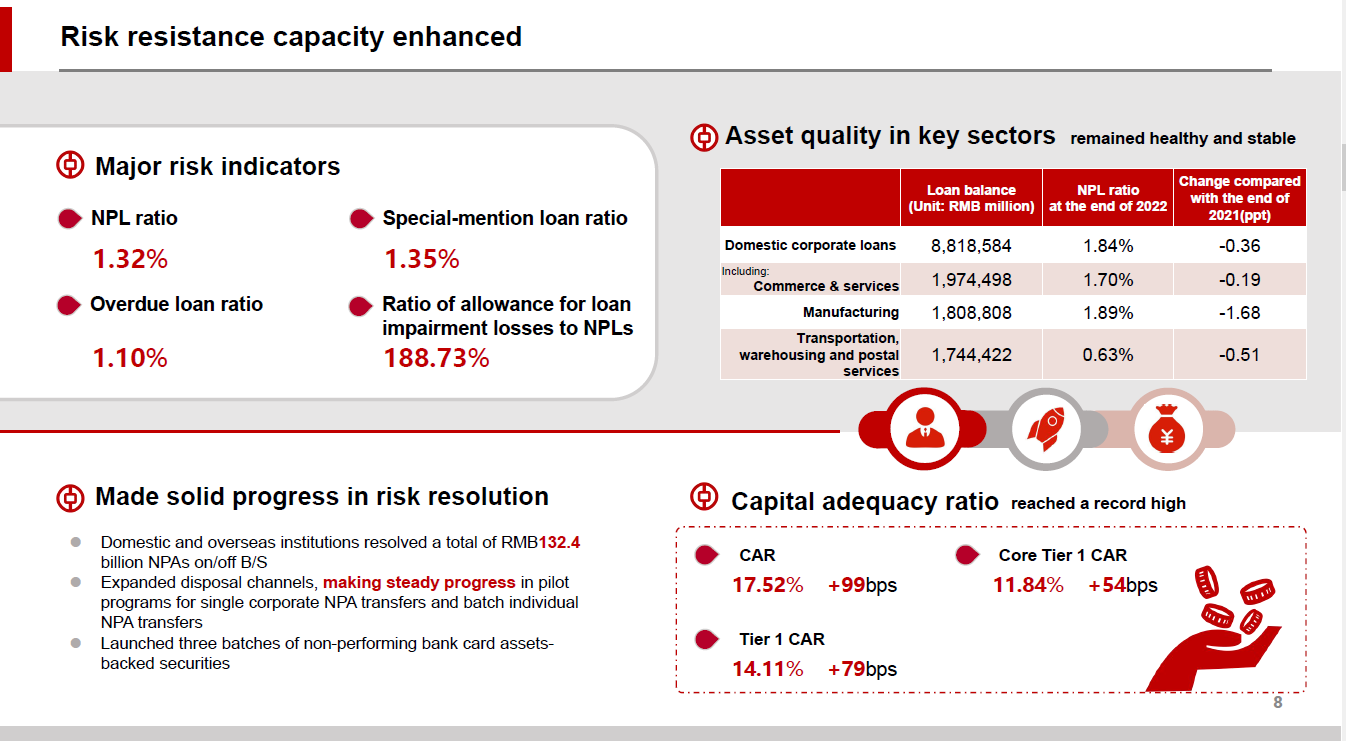

Similar metrics at Bank of China (one of the big 4).

NPL’s 1.3% of loans. Tier 1 Capital at 14%. Looks fine.

Interesting to see in the bottom left of the BOC slide that they are selling off non-performing assets.

That might be an interesting space to get involved in.

Buying Chinese NPL’s.

Oh, and notice in the chart below mortgages only made up 30% of the value of Chinese real estate sales. It means there is very little leverage in Chinese housing at the consumer level.

Yes, the developers are blowing up, but this is not going to be California central valley 2009 with people defaulting on mortgages left and right.

Meanwhile no signs of stress in the interbank market. (SHIBOR).

Tencent

Let’s look at Tencent. One of the biggest gaming software companies in the world, combined with the dominant messaging and payment system for 1.3 billion people. Kind of interesting.