It’s that time of the month to flick through interesting charts.

I put together a 48 slide YWR Killer Charts deck for you with charts from:

BofA Fund Manager Survey,

S&P 500 Earnings Trends

Gold

Shipping

The link to the full chart presentation is at the bottom.

Here are 7 good ones for you starting with the BofA Fund Manager survey

Record China bearishness. Just as Chinese stocks are inflecting upwards it’s reassuring to see record negativity towards the economy. China is on of our big themes (The #1 Trade).

Another good fund manager chart in the deck is that shorting Chinese stocks is a top idea.

No interest in EM. Despite the Fed cutting rates nobody wants to play it through EM. This is another of our big themes (Go time for EM)

Other highlights from the BofA charts:

Investors are overweight cyclicals vs defensives.

Investor underweight in commodities

Investor underweight tech vs banks.

Nobody thinks inflation will rise or wants to own commodities despite Fed cutting rates when the economy is strong.

Investors refuse to get ‘sucked in’ to buying gold. Another theme we like is gold and it’s good to see that despite the record gold ETF flows who retail investors refuse to get ‘sucked in’. This has never happened before, which means this could be ‘the big one’.

The real risk free asset. Consistent central bank buying is the new trend and why gold is trading so well. Central Banks are switching into gold as fast as they can.

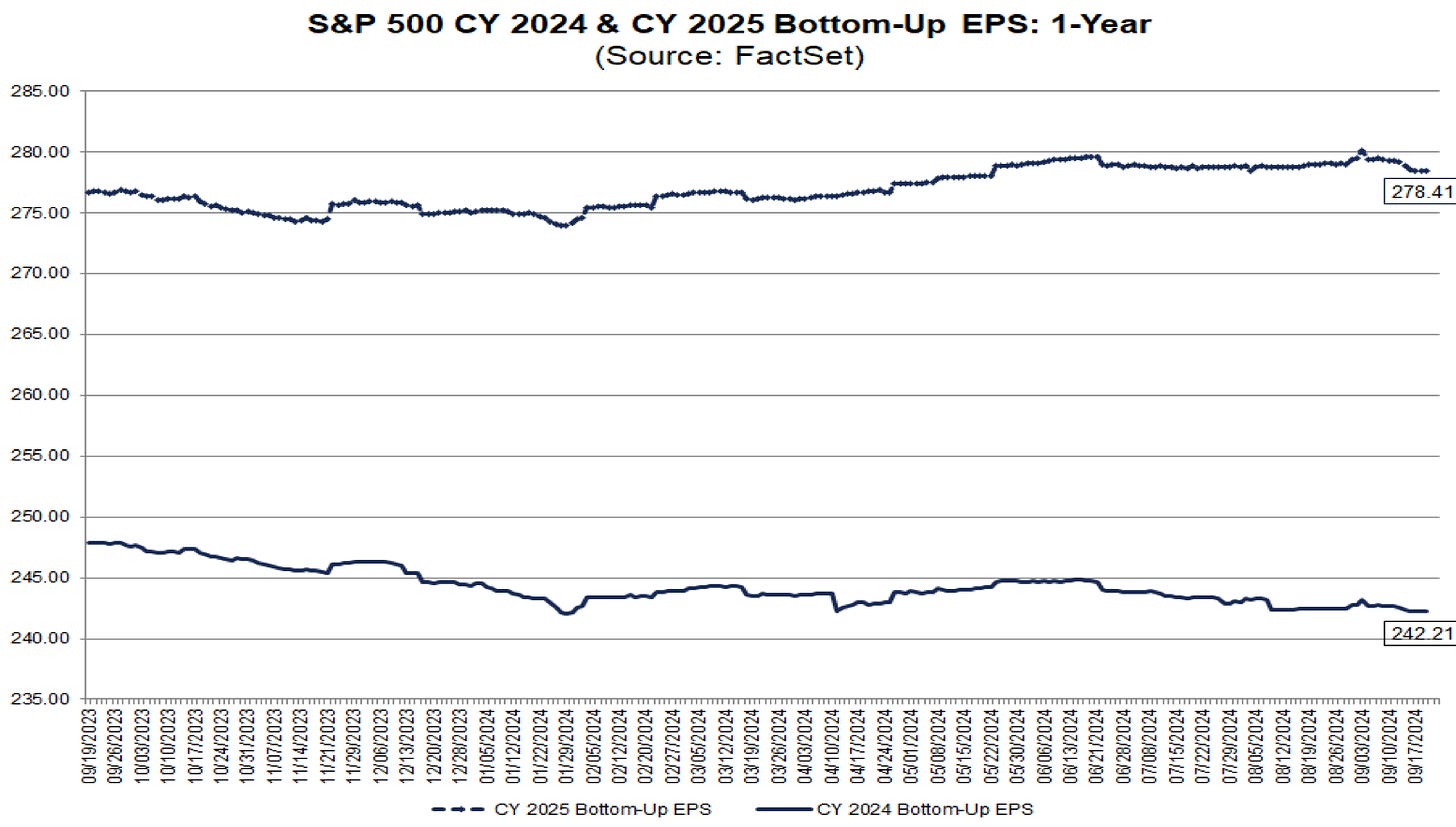

Where is the recession? 2024 and 2025 EPS estimates for the S&P 500 are stable and at record highs with 15% growth projected. Why are we cutting rates again?

The Stealth rally in offshore day rates. No one is paying attention to stocks like Valaris and Saipem, but day rates are crossing $500k again.

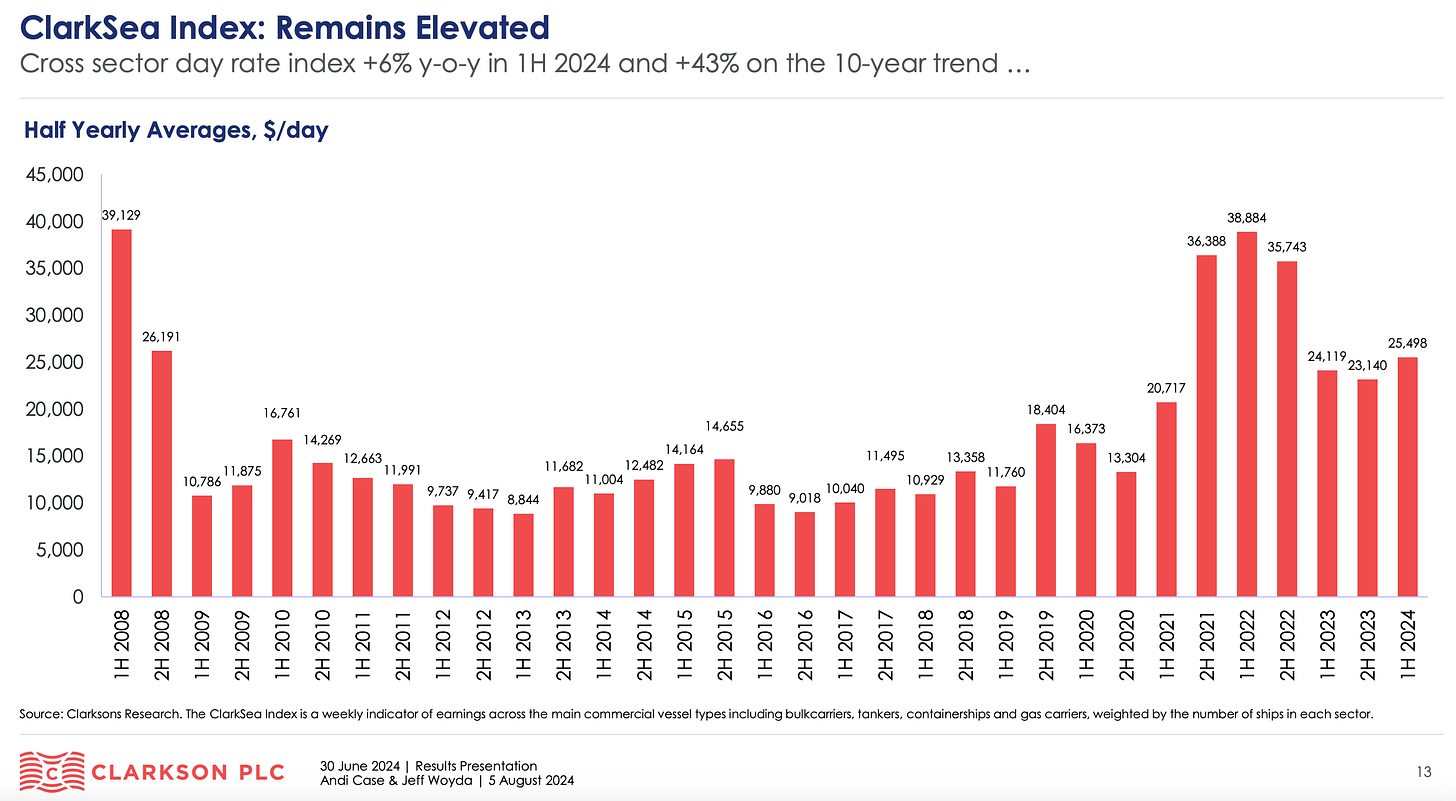

The Stealth Rally in Shipping. Day rates are surprisingly strong across several different shipping sectors. The latest YWR Global Factor Model has also been throwing up a lot of shipping names. It’s a trend nobody is talking about.

The rest of the shipping charts include:

why the Red Sea is bullish for containerships

The aging shipping fleet

The reduced global shipyard capacity

surprising strength in Chinese imports

the current shipping order book versus history

Below is a link to the full Killer Chart slide deck.

All presentations are also available in the YWR Library (www.ywr.world).