YWR: Killer Charts

The smart money says this is 1999 all over again.

The end is near.

Time to take your chips off the table.

But are they right? Is it 1999?

Maybe it’s a good time to review all of our indicators for big warning signs.

For this month’s Killer Charts pack we put together 51 charts on:

GQG’s charts on why this is Dotcom on Steroids.

What retail is posting on Twitter.

BofA Fund Manager Survey

S&P 500 Earnings Estimates

Positioning Review

Goldman Strategy Charts

The full deck is at the end of the post.

But let’s go through some of the highlight charts, and then at the end I will give my thoughts.

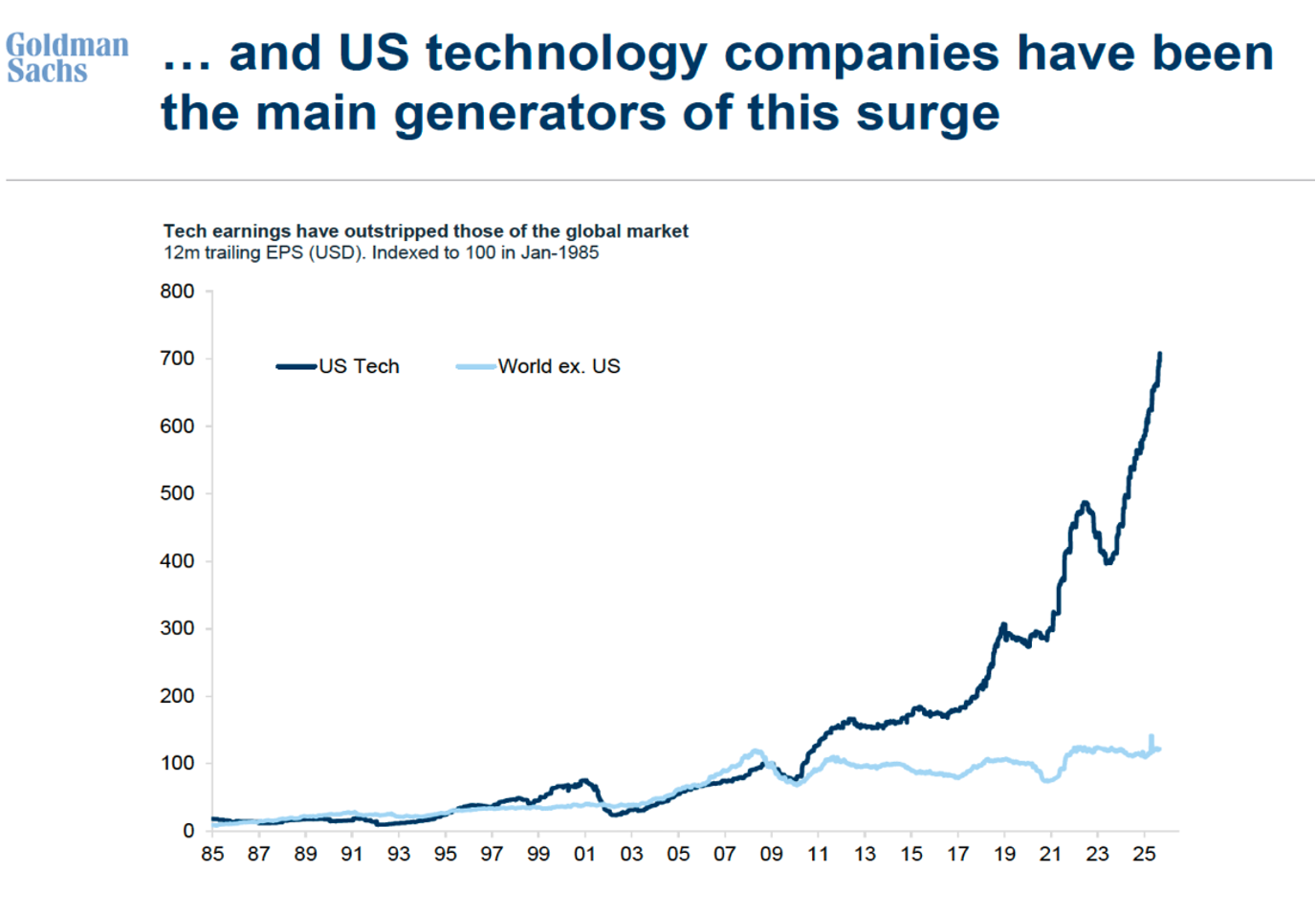

#1 US Tech earnings are driving the entire market.

Like with 1999 it looks like the market is being driven by a US tech bubble.

It’s surprising the EPS for the World ex US looks so bad. Partly, it’s FX (strong $), also the recession in China, and partly it’s the scale of the US tech growth. The rest of the world might be growing, but we can’t see it. Still, it’s surprising, especially the vertical line in tech earnings since 2023.

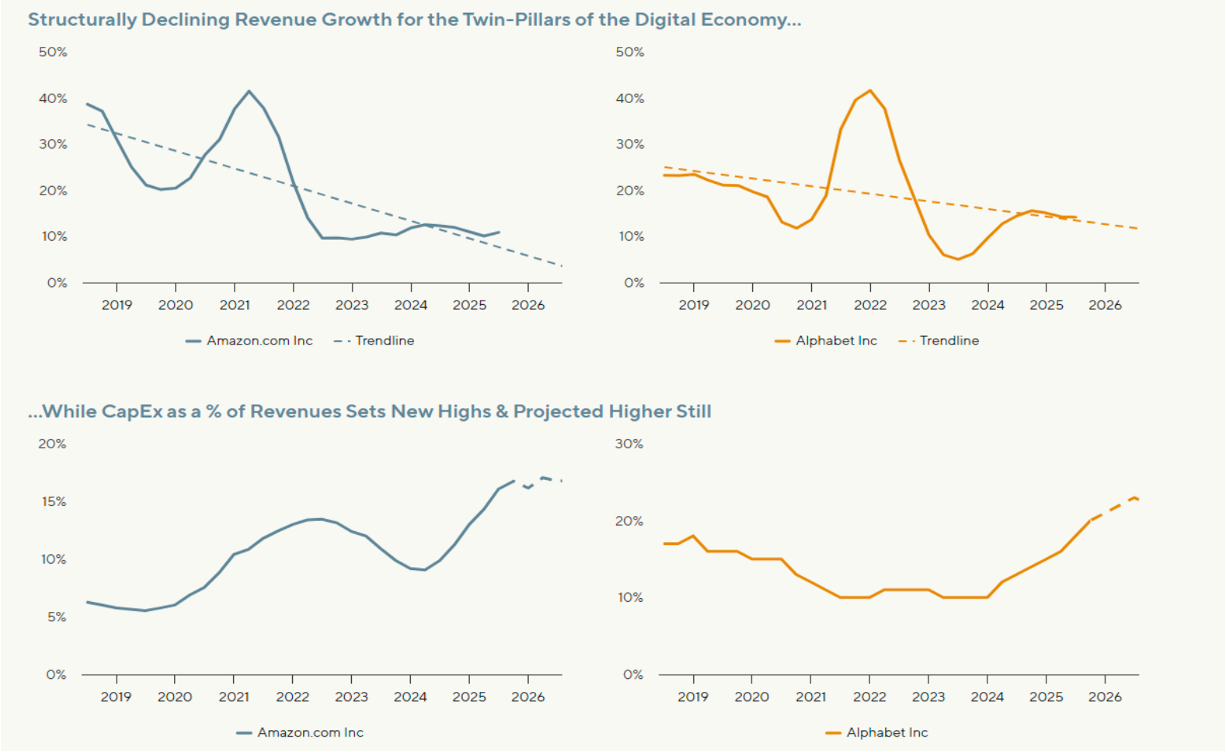

#2. But US tech fundamentals are deteriorating. Everyone is bullish on tech, but is this the top and the best days are behind us? GQG points out in ‘Dotcom on Steroids’ that US tech revenue growth is slowing. The online advertising well is going dry. And with the growth in AI datacenter investments these businesses are no longer free cash flow machines (META, AMZN, MSFT, GOOG, ORCL).

#3 Like 1999 retail traders are cocky and making money.

Is this another sign it’s a top? Retail traders are active and speculating in stocks with high valuations, or no earnings.

#4 Quant Funds, which always get it wrong, are max long again. There has been a great tailwind since April as quant funds slowly got long the market again. But now the equity price trend has been steady, and persistent enough that they are back to maximum long.

Isn’t this another bad sign?

So that’s all concerning.

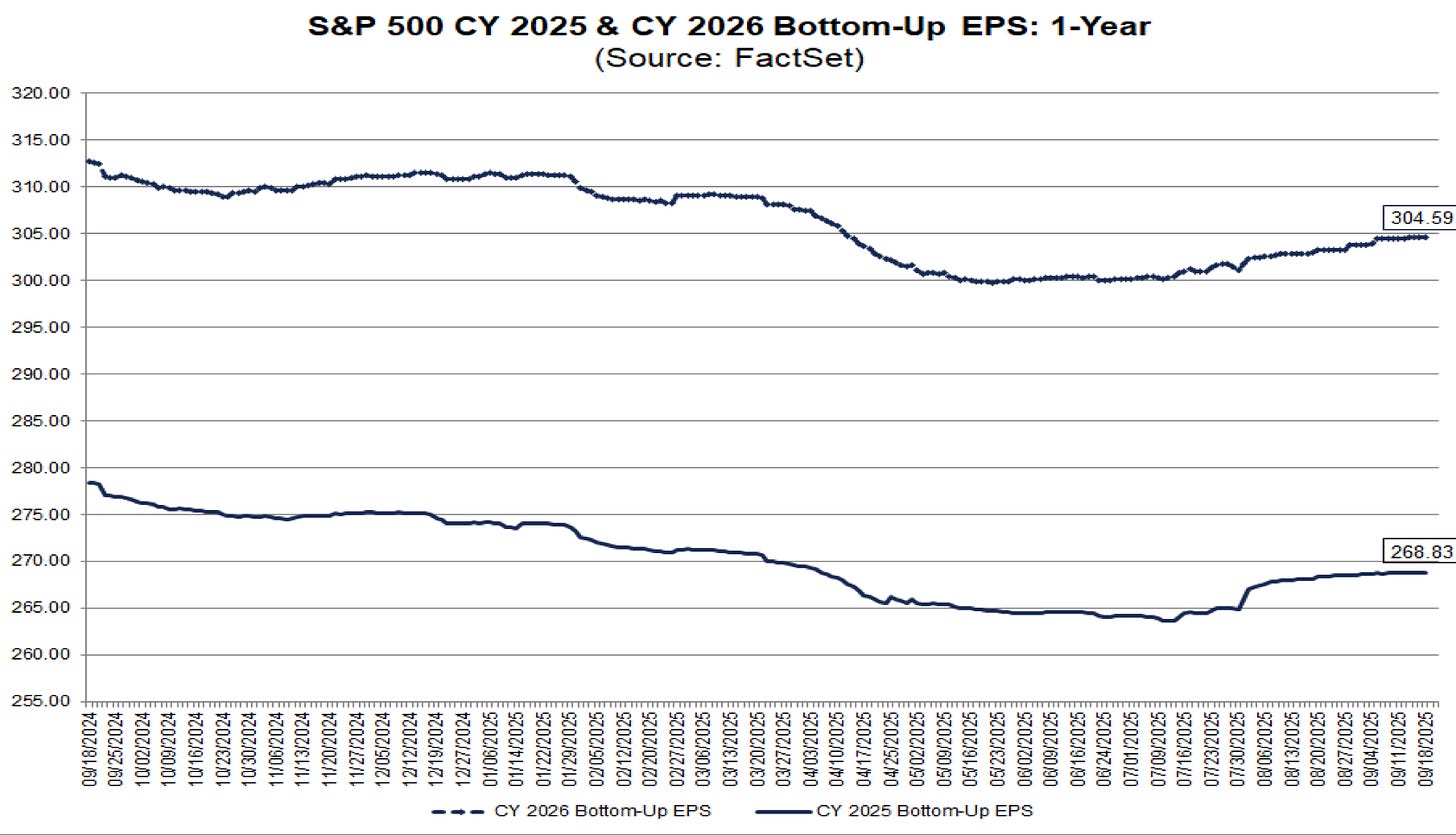

How are earnings estimates holding up?

#5 EPS Estimates for the S&P 500 are stable/trending upwards.

Every bear knows EPS estimates can change quickly, but for now they are not. Earnings forecasts are steady; implying +10% growth for 2025 and +13% growth for 2026.

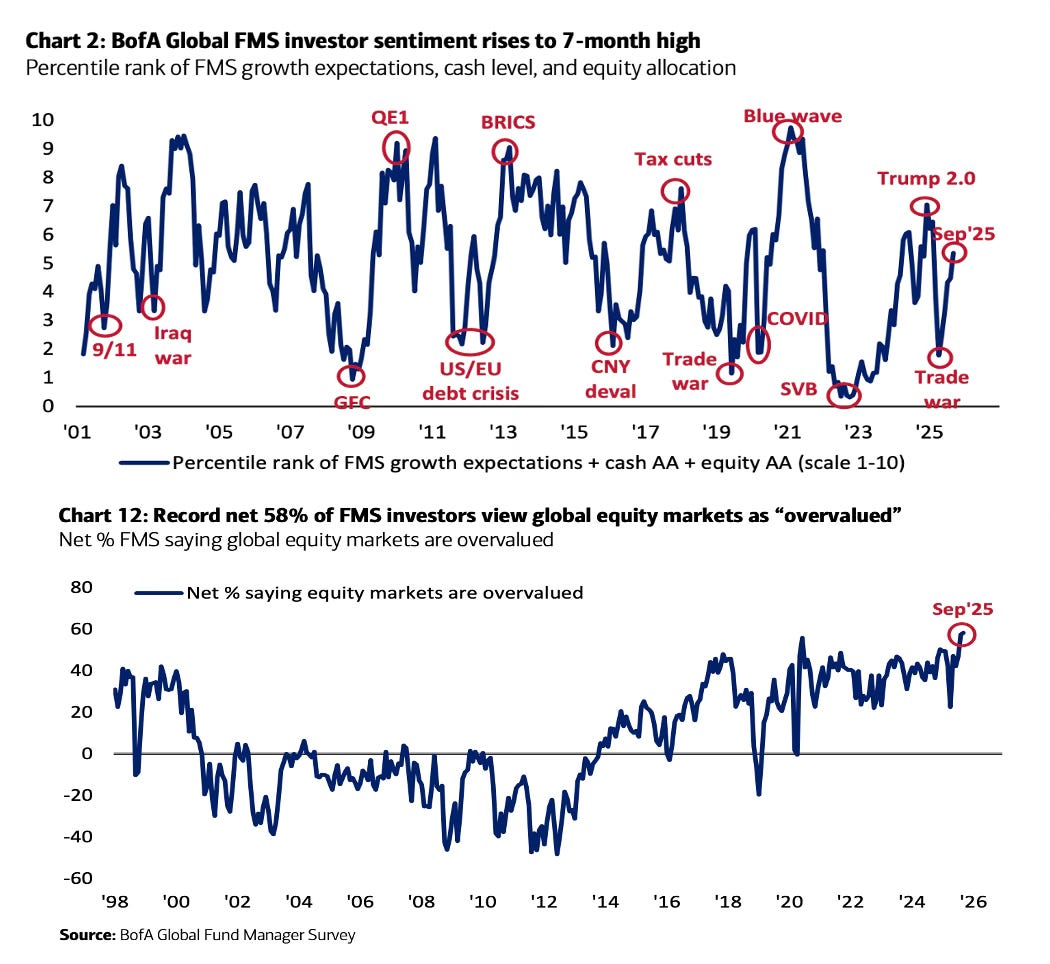

#6 Unlike retail traders, professional fund managers aren’t bullish.

Fund managers aren’t especially bullish. They are unsure about the economy and think the market is too expensive (a bubble). They have scars from 1999 and 2008 and know not to get sucked in again.

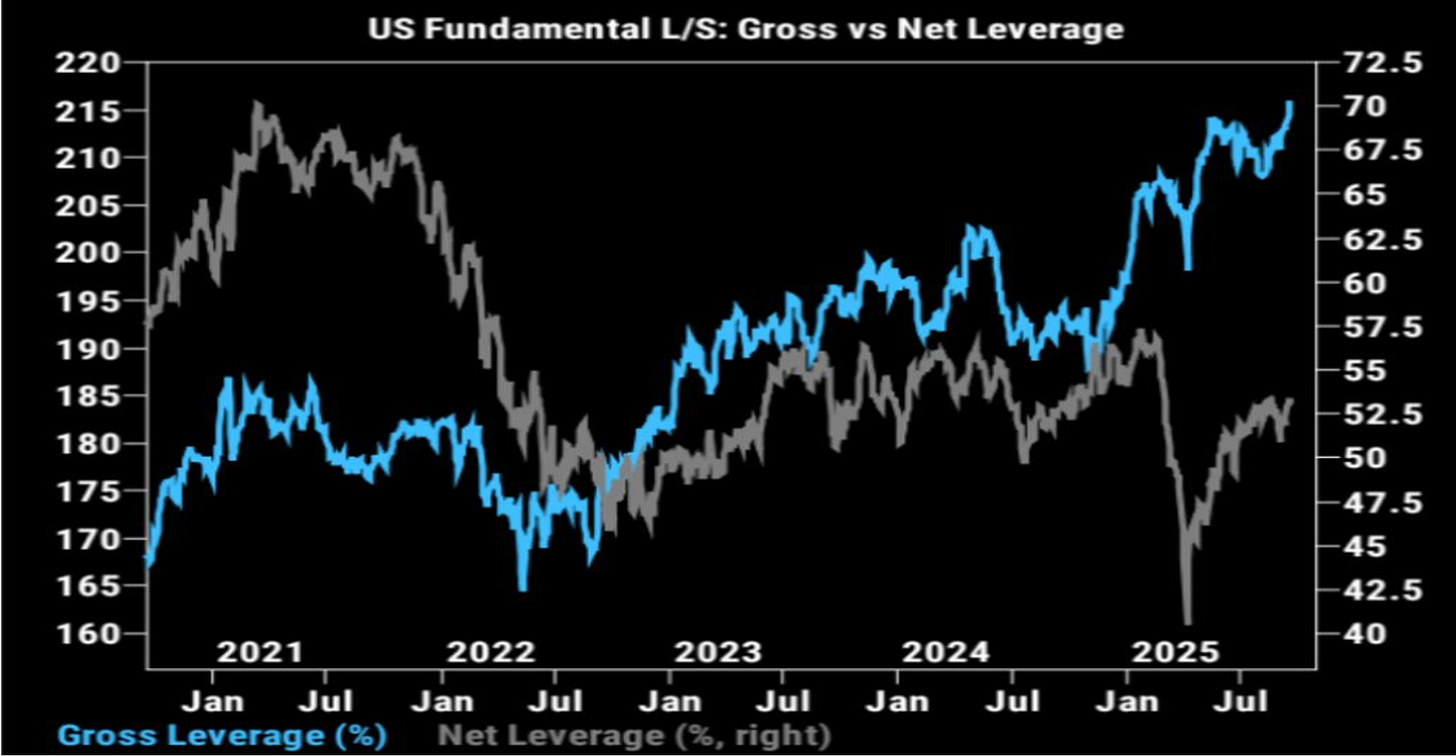

#7 Long/short Hedge funds are also not bullish. Gross exposure is high (‘alpha ideas’), but net exposure is average. Notice in 2021 net exposure (the grey line) was much higher.

In summary, computers and retail are bullish, professional investor humans are not.

So what do we make of this?

Are all the sigs of a top in place? Is it 1999 again?

Is it time to do the prudent thing and reduce equity exposure, especially in the US?

Here’s my take.