YWR: March QARV

QARV.

It’s how we find companies quietly cranking out the numbers (ROE, Earnings Variance), with low debt, but not getting much attention from the market.

Quality at a Reasonable Value (QARV).

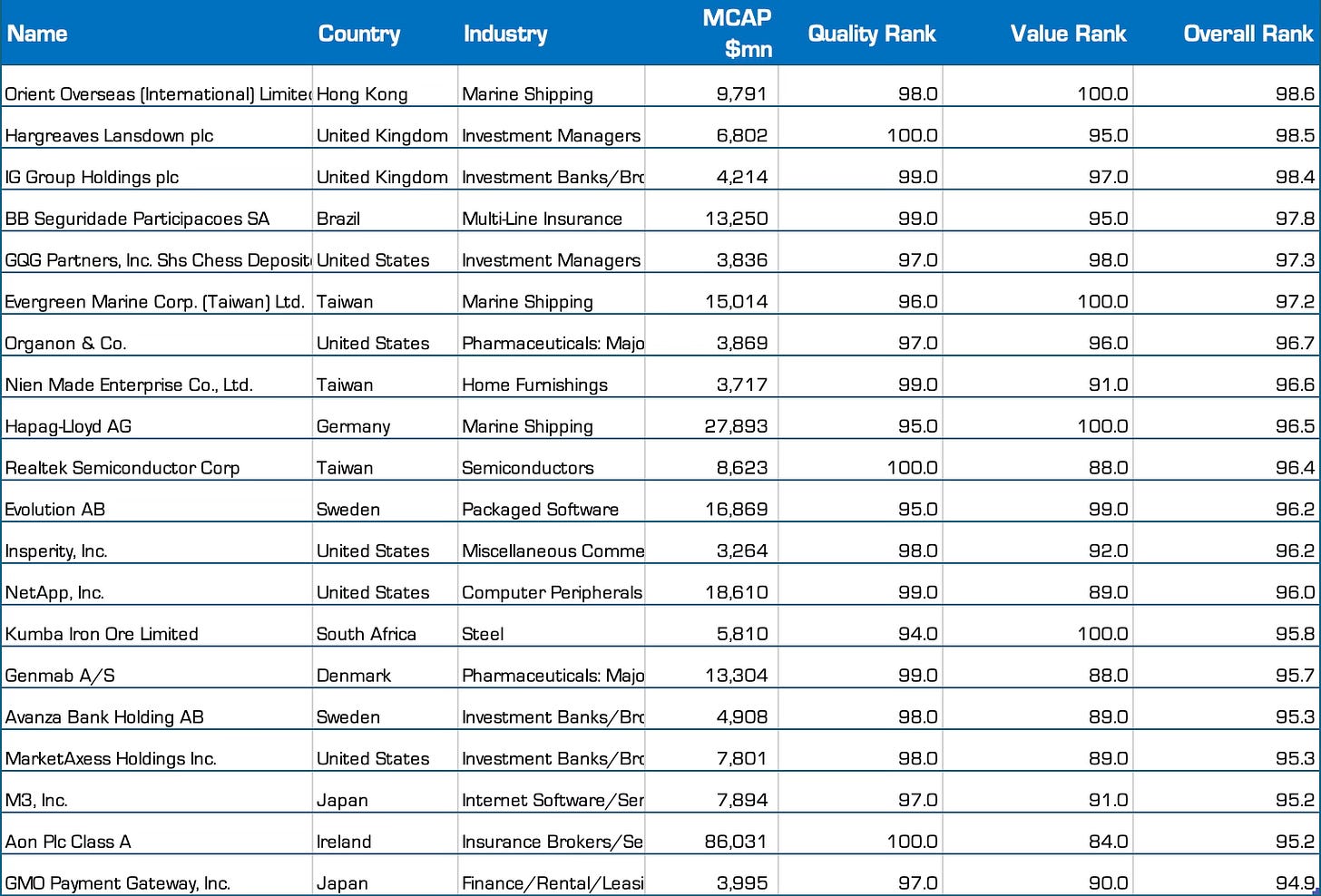

QARV Global Top 20*

An asterisk because I filtered out all the Chinese companies at the top of the list. I know you don’t like investing in China (our #1 theme), so I took them out.

The unfiltered list + user friendly Retool data app are at the bottom of the post.

What do we see when we scan the top names?

Lots of Shipping. I need to do a deeper dive on shipping, because we’re missing something here.

Also iron ore miners. In January we highlighted the iron ore industry and how investors don’t understand the infrastructure moats. Iron ore companies generate >20% ROE’s, with P/E’s sub 10x (The New QARV).

But there is another industry which stands out. And it’s hated.

YWR Who am I Riddle:

I’m one of the most hated industries.

Not offshore drilling. But close.

And yet strangely, my biggest haters are my members.

They don’t want to invest in me.

I guess I hate myself.

Who am I?

Give up?

Active investment managers.

Specifically, managers of public equities.

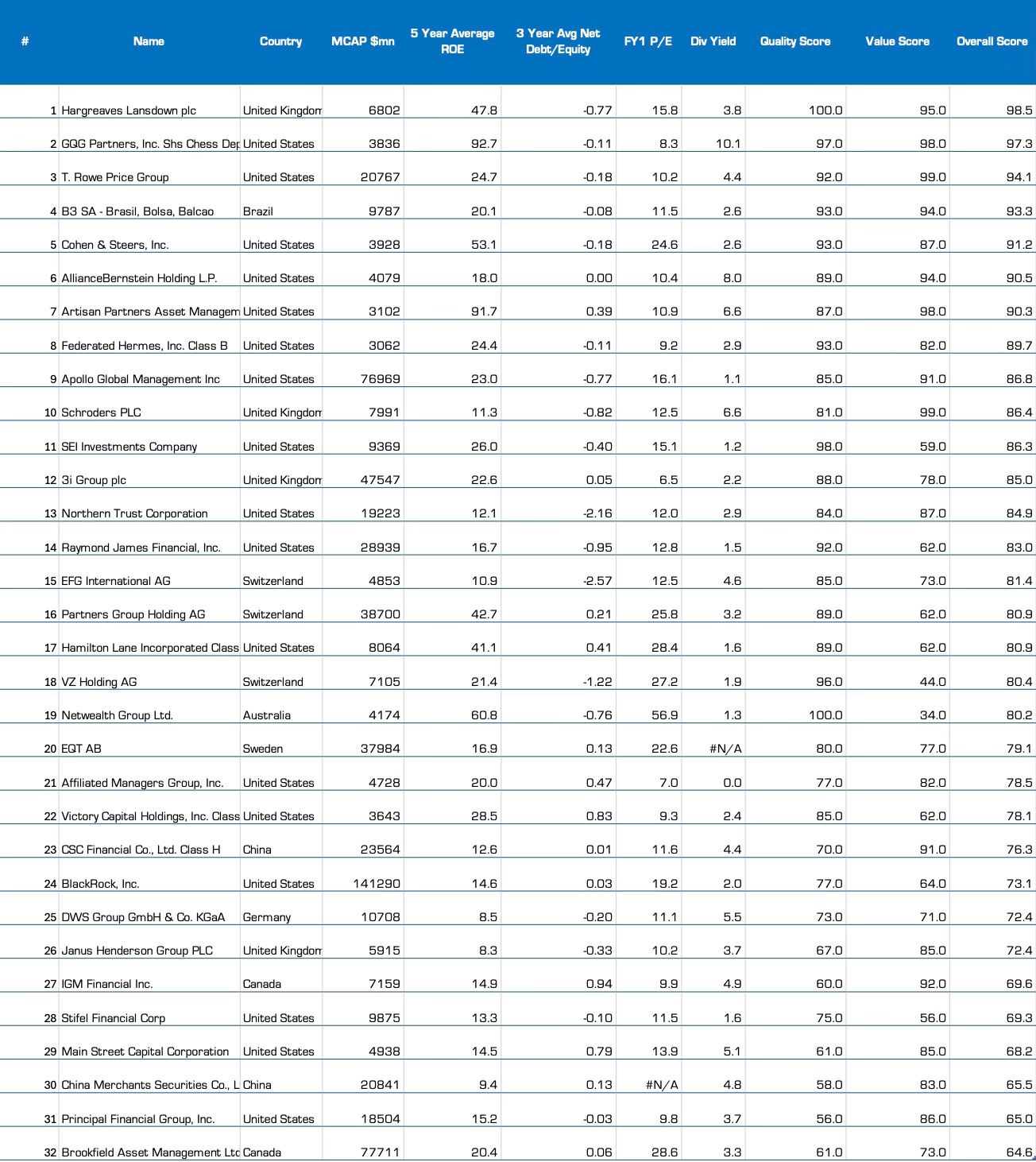

Investment Managers

Why do Trowe Price, GQG, Artisan, Federated, Alliance Bernstein, and Affiliated Managers generate 20% ROE’s and yet trade on P/E’s of 10-12x with dividend yields of 4-10%?

Because of this chart. Flows out of active into passive ETF’s.

Active managers of publicly traded securities are dinosaurs. Something from the 90’s. Something from the good old days of Peter Lynch back when people cared what portfolio managers thought.

Right?

OK. Maybe mutual fund brands still exist, but they’re a death spiral. Value traps. The growth is all ETF’s and Alts.

Right?

That stereotype is why nobody cares about the profitability and low valuations of these companies.

But there are shades of gray to everything.

And those shades are where you make money.

TROW and AB EPS Trend. Not dead yet.

Dig into Alliance Bernstein for example, which has an 8% dividend yield.

You realize the whole world of asset management isn’t US equity index ETF’s. There are other places to play and win, like fixed income ($300bn) and multi-asset. And both TROW and AB have launched their own actively managed ETF’s.

You also realise the whole world isn’t the US. There is money to be made globally in Japan, Asia and Europe, plus Private Wealth.

Another trend you see is public managers getting into private markets asset classes, like private credit, which is interesting because the private asset managers all trade on P/E’s of >20x. That space is about to get much more competitive, something the public markets guys are used to.

And AB is doing other smart things. Like saving $80mn/year by leaving NYC and moving their HQ to Nashville.

Maybe active managers aren’t dead yet.

Please dig into all the source data yourself.

Below are links to:

March QARV rankings on over 3,000 stocks

Retool QARV Data App.

Alliance Bernstein Investor presentation.

Everything is also available at www.ywr.world