YWR: Don't be a Muppet

There are cycles to everything. It’s be hard to remember, but back in October everyone was sure the market was going to crash. Prevailing sentiment was that the yield curve was inverted, we were going to have a recession, and the market wouldn’t be able handle a 5.5% Fed Funds rate.

Sentiment was so bad we were forced to publish 15 Charts Say the Market goes Higher. A quick trip down memory lane.

Retail sentiment was awful….

Hedge funds were shorting…

Trend following CTA’s were max short too….

Amazing how bearish we were just 5 months ago.

But it happens, we are human.

And where are we today?

Retail sentiment is now massively bullish.

Tech fund inflows have never been higher.

Semi ETF’s are back to getting record flows.

Momentum is the best performing strategy.

‘Momentum’ is a technical term for chasing whatever has already gone up. It implies CTA’s are long too.

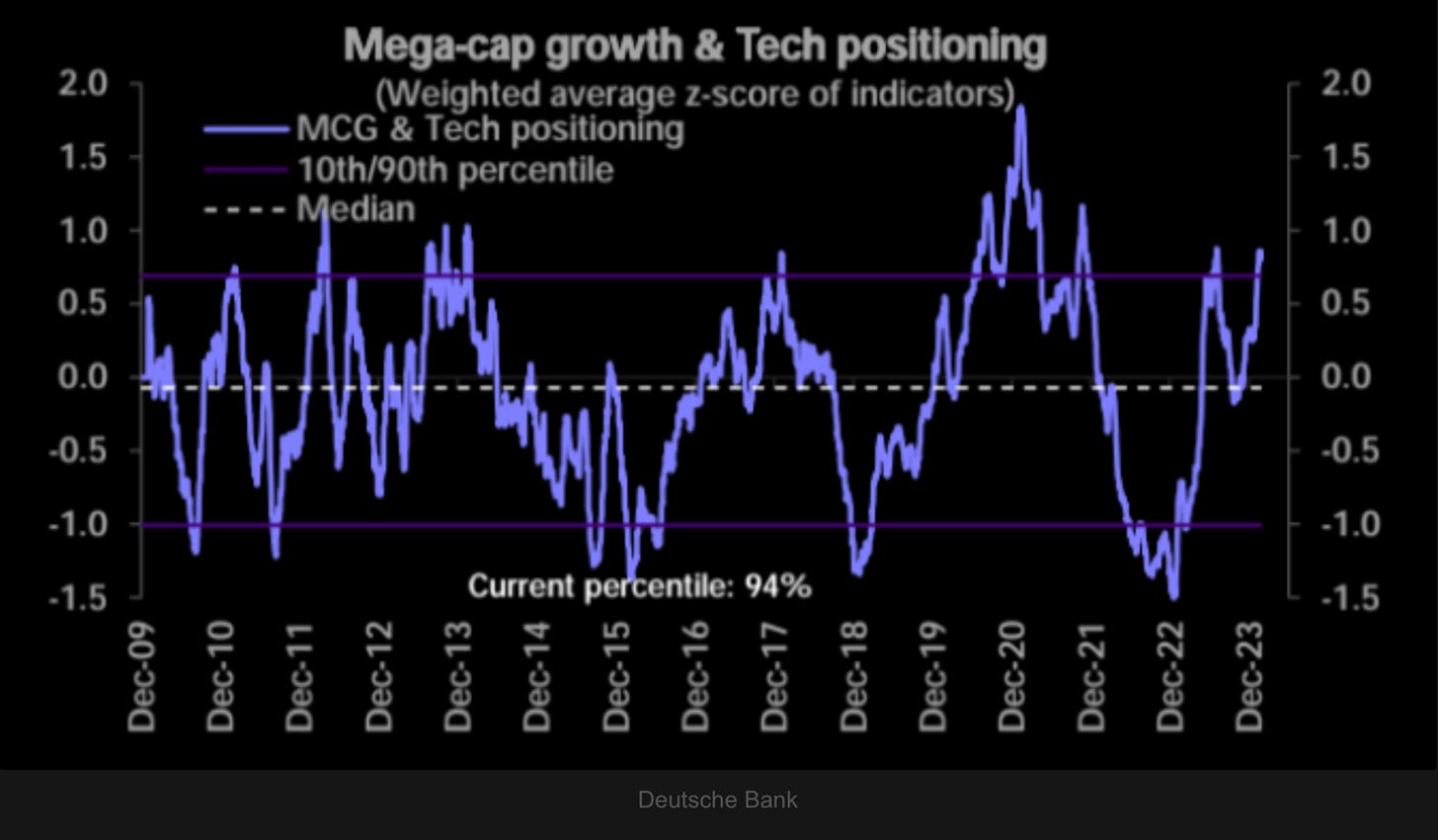

Hedge funds have covered their shorts and are now max long large cap growth and tech.

Bitcoin’s RSI hits 95.

Another sign of a retail frenzy.

Options expert Amy Wu articulates the overall picture well.

‘The Right Tail is the new Left Tail’. Investors are using options to capture upside, not protect against downside.

The call option buying is historic and really in just 3-4 stocks (NVDA and AMD).

Speaking to investors there is nothing else globally that is interesting, which crowds the flows into the same stocks and the US (‘US Exceptionalism’).

China starting to work is the only thing that can break the cycle.

The AI trend is amazing, and I’m not saying to sell what you own and go to cash, but I am saying it is highly risky to be buying more tech and Bitcoin here.

Buy something else instead. Maybe buy some gold. There are so many opportunities in the rest of the world. There are dripping roasts everywhere.

Yes, the retail FOMO is intense, but you are supposed to be a professional. You are supposed to be the steady hand. There will be tech carnage again, and when retail is puking we will be buying again, but that time is not now.

So how could it change? How does the rally broaden out?

How do the other sectors start to work and get inflows?